Smart finance technologies sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. From artificial intelligence to blockchain and automation, these technologies are reshaping the financial landscape in unprecedented ways.

Overview of Smart Finance Technologies

Smart finance technologies refer to the innovative tools and solutions that leverage artificial intelligence, machine learning, and data analytics to optimize financial processes and decision-making. These technologies enable businesses to automate tasks, improve accuracy, and enhance efficiency in managing their finances.

Key Examples of Smart Finance Technologies

- Robotic Process Automation (RPA): RPA software robots can perform repetitive tasks such as data entry, invoice processing, and report generation, freeing up employees to focus on more strategic activities.

- Machine Learning Algorithms: These algorithms analyze historical data to predict trends, identify patterns, and make data-driven decisions in areas like risk management, fraud detection, and investment strategies.

- Blockchain Technology: Blockchain ensures secure and transparent transactions through decentralized ledgers, enabling faster and more reliable payments, smart contracts, and supply chain finance.

Benefits of Incorporating Smart Finance Technologies in Businesses

- Increased Efficiency: Smart finance technologies streamline processes, reduce manual errors, and accelerate decision-making, leading to faster financial operations and cost savings.

- Enhanced Accuracy: By automating tasks and analyzing vast amounts of data, these technologies improve the accuracy of financial forecasts, risk assessments, and compliance monitoring.

- Better Decision-Making: With real-time insights and predictive analytics, businesses can make informed decisions, identify opportunities, and mitigate risks more effectively.

Artificial Intelligence in Finance

Artificial intelligence (AI) is transforming the finance industry by revolutionizing how financial services are delivered. Through the power of AI, financial institutions can enhance efficiency, improve decision-making processes, and provide personalized services to their customers.

Applications of AI in Financial Services

- Algorithmic Trading: AI-powered algorithms analyze market trends and execute trades at optimal times, reducing human error and increasing profitability.

- Risk Management: AI models can assess risks in real-time, helping institutions identify potential threats and take preventive measures.

- Customer Service: Chatbots and virtual assistants powered by AI provide 24/7 customer support, answering queries and resolving issues promptly.

- Fraud Detection: AI algorithms can detect fraudulent activities by analyzing patterns in transactions and flagging suspicious behavior.

Comparison of Traditional Finance Processes with AI-Driven Ones

- Speed and Accuracy: AI-driven processes are faster and more accurate than traditional methods, enabling quick decision-making and reducing manual errors.

- Cost Efficiency: AI helps in automating repetitive tasks, reducing operational costs and increasing overall efficiency in financial operations.

- Predictive Analytics: AI algorithms can analyze vast amounts of data to predict future trends and outcomes, empowering institutions to make informed decisions.

- Personalization: AI enables personalized recommendations and services based on customer behavior and preferences, enhancing customer experience and loyalty.

Blockchain and Cryptocurrency

Blockchain technology plays a crucial role in smart finance technologies by providing a secure and transparent way to record transactions. It is a decentralized and distributed ledger system that enhances the efficiency and security of financial transactions.

Role of Blockchain in Smart Finance Technologies

- Blockchain ensures immutability and transparency in financial transactions, reducing the risk of fraud and error.

- Smart contracts built on blockchain technology automate processes and ensure compliance with predefined rules.

- Blockchain enables faster cross-border transactions at lower costs compared to traditional methods.

Cryptocurrency Changing the Financial Landscape

- Cryptocurrencies like Bitcoin and Ethereum provide an alternative to traditional currencies, allowing for peer-to-peer transactions without the need for intermediaries.

- Cryptocurrency investments have gained popularity, offering potential high returns but also carrying high volatility risks.

- Cryptocurrency exchanges provide a platform for buying, selling, and trading digital assets, expanding the financial market ecosystem.

Potential Impact of Blockchain on Traditional Banking Systems

- Blockchain technology can streamline banking operations, reducing costs and processing times for transactions.

- By eliminating intermediaries, blockchain can enhance security and privacy in banking systems, protecting customer data and reducing the risk of cyberattacks.

- Traditional banks are exploring blockchain applications for cross-border payments, trade finance, and identity verification to improve efficiency and customer experience.

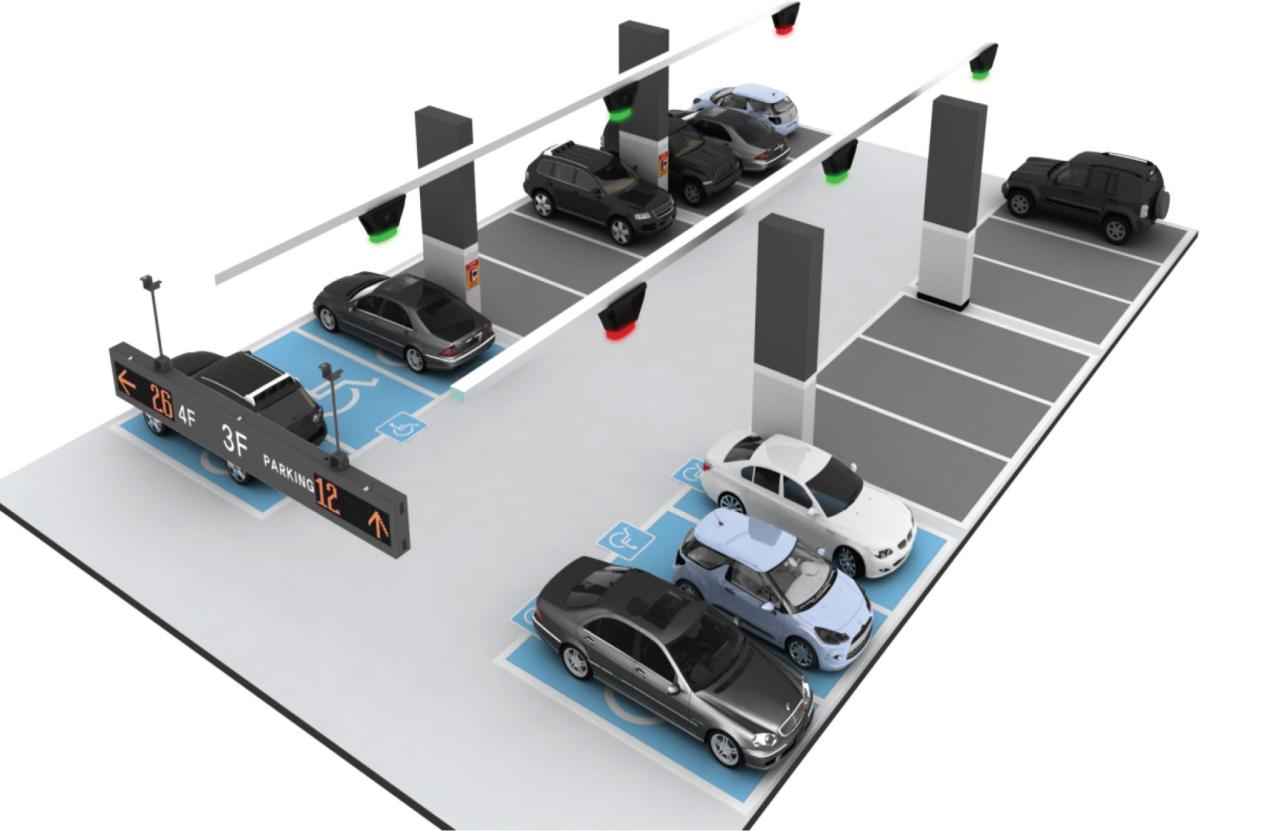

Automation in Financial Management: Smart Finance Technologies

Automation plays a crucial role in streamlining financial management processes, enhancing efficiency, accuracy, and reducing manual errors. By leveraging automated tools and technologies, businesses can optimize their financial operations and make data-driven decisions swiftly.

Automated Tools in Financial Planning

- Robo-advisors: These automated platforms use algorithms to provide investment advice and portfolio management services to clients, eliminating the need for human financial advisors.

- Expense Management Software: Tools like Expensify and Concur automate the process of tracking and categorizing expenses, saving time and reducing the risk of errors.

- Automated Invoicing Systems: Platforms like QuickBooks and FreshBooks automate the invoicing process, sending out invoices, tracking payments, and managing cash flow efficiently.

Challenges and Opportunities of Implementing Automation in Finance, Smart finance technologies

- Challenges:

- Initial Investment: Implementing automation technologies can require a significant upfront investment in software, training, and infrastructure.

- Data Security Risks: Automation exposes financial data to potential cyber threats, requiring robust security measures to safeguard sensitive information.

- Resistance to Change: Some employees may resist automation due to fear of job displacement or lack of understanding of the new technologies.

- Opportunities:

- Increased Efficiency: Automation streamlines repetitive tasks, allowing employees to focus on strategic financial decision-making and analysis.

- Improved Accuracy: Automated tools reduce the risk of human errors in financial calculations and reporting, ensuring data integrity.

- Enhanced Compliance: Automated systems can help ensure regulatory compliance by implementing predefined rules and protocols.

Expert Answers

How are smart finance technologies transforming traditional financial processes?

Smart finance technologies are automating tasks, improving accuracy, and providing real-time insights, revolutionizing how financial operations are conducted.

What are some examples of smart finance technologies in use today?

Examples include AI-powered chatbots for customer service, blockchain for secure transactions, and automated tools for financial planning.

What benefits do smart finance technologies offer to businesses?

Smart finance technologies enhance efficiency, reduce costs, minimize errors, and enable better strategic decision-making for businesses.